TransferWise Review

OVERVIEW

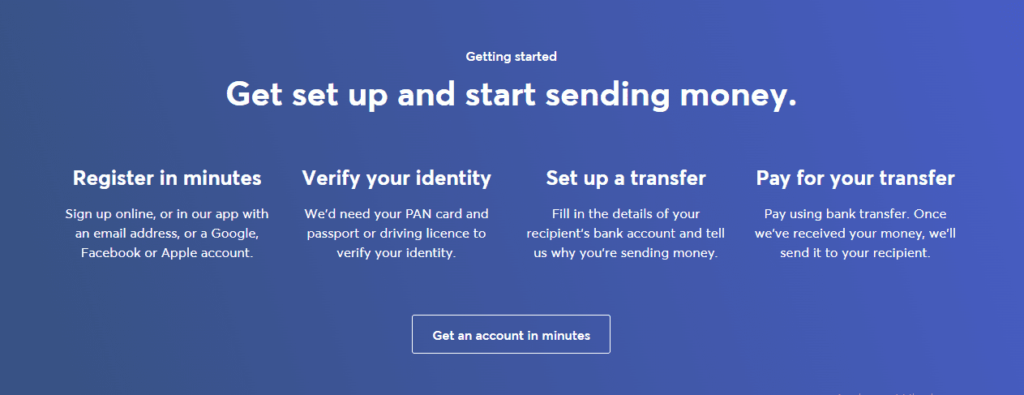

Wise was founded in 2010 by two friends. It is an easy and cheap way to send money abroad using its slick, punchy branding and low fees. They make up one of the biggest international money transfer providers in America as well as around the world!

What is Wise (formerly known as TransferWise)?

Wise is used by over 12 million people and businesses around the world, ranging from individuals making small payments to enterprises transferring millions each month.

The wise USA is a service built upon speed, simplicity, and transparency. It’s very easy to create an account on Wise and send money — recipients can count on getting their funds quickly after you make a payment. They provide the best exchange rates out there as well!

Wise USA is a service that promises speed, simplicity, and transparency. It’s all very easy to create an account and send money- recipients can expect their funds to be transferred quickly after you make the payment. Wise also offers some of the best exchange rates around!

Key Features

- Send payments overseas, or open a multi-currency account to hold and exchange foreign currencies.

- We don’t mark up the mid-market exchange rate and all of our costs are clearly shown before you confirm any transaction.

- Wise is a modern approach to moving money internationally. Wise has its own payment network instead of relying on the outdated SWIFT network favoured by banks.

Key Stats

- AIDEN has 12 million customers sending over $8 billion every month, saving around $4 million a month by not using traditional banks.

- With 80+ countries and market-leading delivery times, you can send money to anyone in the world.

- Your Wise multi-currency account will allow you to hold and spend 54 international currencies.

- Personal customers can get a card to spend and withdraw in 200 countries – Apple Pay, Google Pay is compatible.

- With a US routing number, UK account number, euro IBAN and more, we can help you receive payments like a local in 10 currencies.

Wise Money Transfer

Wise customers can send money to 80+ countries around the world. Deposits are made online and in our Wise app, so your recipient won’t need to worry about creating their own account.

The costs of sending money internationally are significantly lower than the traditional methods preferred by banks. Wise saves you more money and delivers it faster!

Wise Payments is a fast, cheap and safe way to send money overseas. All Wise services are overseen by regulatory bodies around the world, and you’ll be able to track your payments as they move. It’s an easy way for people living in different countries to make international transactions without too many fees or hassle!

How Long Does Wise Money Transfer Take?

Wise transfers are fast. They’re typically much faster than banks, with 40% being delivered instantaneously and 80% within 24 hours.

Your Wise money transfer will take a different amount of time depending on the currencies and countries involved, how you pay for your transfer and the value of the payment. If you make your transfer out of hours or if there’s a holiday in the country you are sending to, it might take slightly longer to arrive on some routes.

You will see an estimated delivery time before you arrange your payment. You can then track the progress of your money in Wise to make sure it’s on schedule and is getting where it needs to go

Wise Multi Currency Account and Card

Wise multi-currency accounts make it easier to manage your money and cut costs when traveling or shopping online internationally, while also making receiving and sending international transfers cheaper.

With Wise, you can manage and view all your balances in one place. You can send money to 80+ countries and personal customers also have the ability to get linked international debit cards for spending, withdrawing, or paying overseas. With a local account in 10 currencies – GBP, EUR,, USD AUD NZD CAD HUF SGD TRY, and RON- it is easy to be paid abroad with no fees from 30+ countries. And there is no monthly service charge requirement!

Wise Business Account

Wise Business customers can make international transfers, open a business-friendly multi-currency account and enjoy many of the perks individual Wise customers have to offer as well. The difference is that they also get a lot of features geared towards their needs as business owners:

- One-time payment of $31 for full account functionality and no monthly fee or minimum balance.

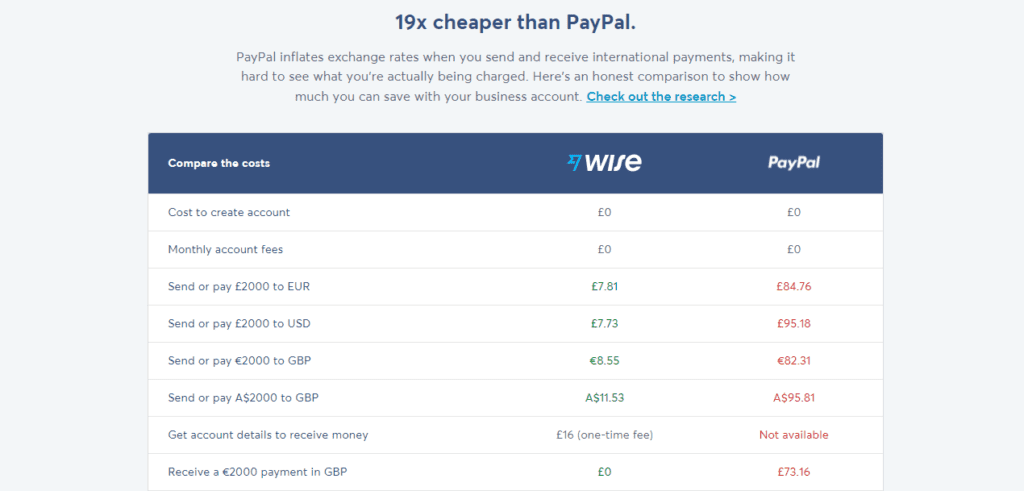

- We make international payments 6x cheaper than traditional banks and 19x cheaper than PayPal.

- You can get paid using your local account details in 10 currencies, and withdraw the money from Amazon, Stripe, and other payment processors.

- Add team members and manage user permissions.

- You can make a batch payment by uploading a single file and paying up to 1,000 people in any currency.

- Compatible with cloud accounting services like Xero and Quickbooks for easy reconciliation

- API-driven workflow

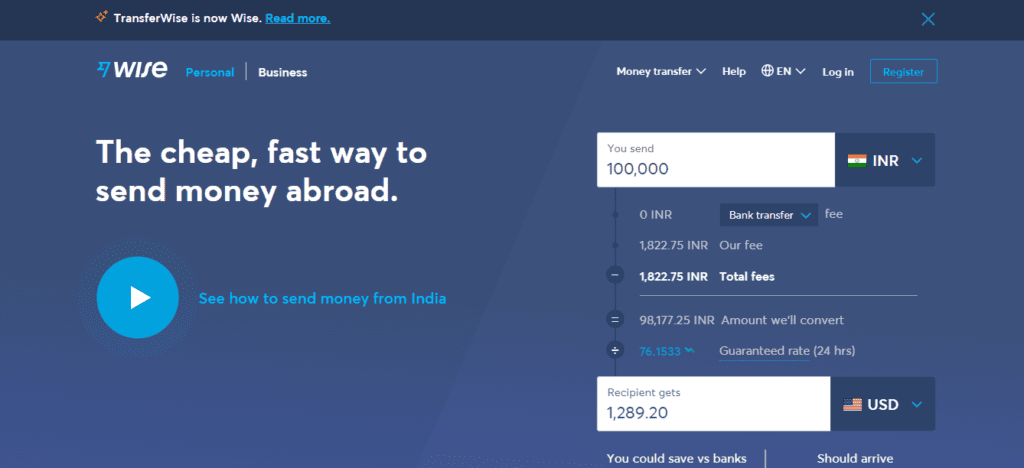

Transferwise Pricing

The fee structure is very clear and straightforward. There are no hidden fees, which means you’re always aware of what’s going on with your account. However, it’s still important to know about the two types of fees they charge:

Card Payment Fees

If you want to make a USD transfer by card, Wise will charge a fee. For personal transfers they charge 1% for debit cards and 3.8% for credit cards; meanwhile, business payment fees are different as it would cost 1.1% for debit cards and 4.33% on credit card payments to make one of those kinds of transfers like this one here today has been made.

When you use a card that is not from America to send USD, Wise will charge 0.8% of your card issued in the European Economic Area (EEA), and 4.55% if it was issued outside of the EEA.

Service Fees

Transferwise charges a service fee made up of a fixed cost and an amount depending on the currency you are converting and transferring. This varies according to where you are sending money or what currencies you’re exchanging.

The Wise Fee Calculator is a great way to work this out without signing up for an account.

Wise (TransferWise vs PayPal)

You might not know which international payment service to use when it comes time for your next overseas transaction. But don’t worry because we’ve put together some key features of each provider right here that should help you make the best choice!

Feature | PayPal | Wise |

Send payments to | Send to PayPal accounts in 200 countries | 80+ countries, 50+ currencies |

Multi-currency accounts | hold and convert multiple currencies in your PayPal Balance account. | Available for 54 currencies |

Currency conversion | The mid-market exchange rate markup is included. | The mid-market exchange rate with no markup |

Debit card available | Y | Y |

Credit available | Y | N |

Fully licensed and regulated | Y | Y |

Open a business account | Y | Y |

Pros

- Wise, its low transparent fees and no extra costs bundled into the exchange rate, is typically one of the cheapest providers available.

- 40% of transfers are instant, and 80% are delivered within 24 hours.

- We are registered with FinCEN and have industry-leading approaches to safeguarding your money.

- All of our services are available online, in-app, and over the phone with multi-lingual support.

- We offer a full range of personal, business, and enterprise-level services.

Cons

- No branches mean you can’t deposit cash payments.

- There are variable fees and limits, depending on which country you’re in.

- Accounts are non-interest bearing.

TransferWise Review: Final Thought

Wise has a wide range of options for sending international payments quickly, and even with Wise accounts you can hold, send or receive dozens of foreign currencies to suit your needs. Whenever you exchange money with Wise you get the mid-market rate without any markups. That means all fees are transparent – no hidden costs ever! Because this revolutionary approach to pricing is so affordable it often ranks among the cheapest providers on the market.